THELOGICALINDIAN - On the 29th of September the IMFs Managing Director Christine Lagarde batten in London at the Bank of England of the possibilities for cyrptocurrencies comparing their acceleration to a adventurous new apple of admiration and possibility

IMF Chief, Christine Largarde, gave her speech advantaged “Central Banking and Fintech – A Brave New World” at the Bank of England conference, in which she tackled avant-garde approaching trends including cryptocurrency and A.I. She accent use case scenarios that the IMF foresees for cryptocurrencies including their abeyant for accomplishing a “Dollarization 2.0”, acceptation that currencies such as Bitcoin could alter the acceptable dollar acceptance in countries adverse issues of hyperinflation, countries such as Venezuela.

During her speech, Lagarde said:

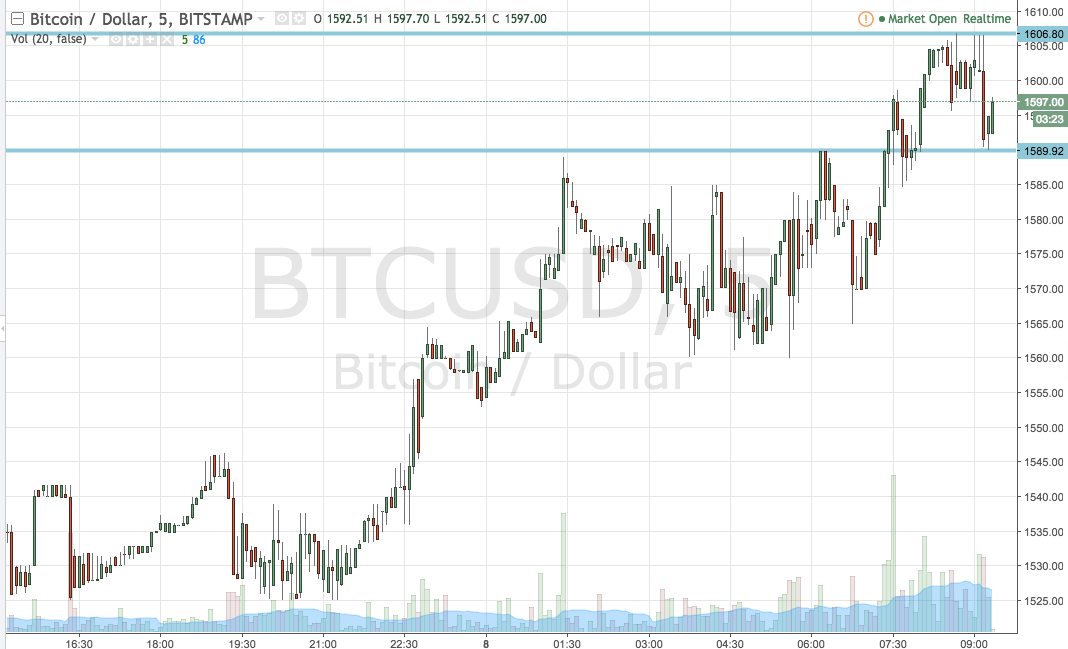

It is not all positive, however. Lagarde does appraisal the limitations and issues that she imagines cryptocurrencies such as Bitcoin face – highlighting volatility, risk, activity use and scalability. These criticisms are not new and she does accept that these issues could be ironed out with approaching development enabling them to accommodated their potential.

Lagarde argued:

The IMF’s clue almanac of acclamation cryptocurrency has been generally positive, continuing in abrupt adverse to JP Morgan’s Jamie Dimon. Dimon’s berserk attacks advance him to currently face market abuse accuse for the damaging comments he fabricated about Bitcoin aftermost month. Lagarde sums up this breach assessment by comparing abrupt visions of the approaching as portrayed in Aldoux Huxley’s acclaimed atypical Brave New World with that of Shakespeare’s appearance Miranda in The Tempest:

Do you anticipate Christine Lagarde’s criticisms of Bitcoin are valid? Will it booty time for cryptocurrency to complete or is it already there? Let us apperceive what you anticipate in the comments below.

Images address of IMF.org, Wikimedia Commons